Gauge User Engagement in Your Fintech App with Palzin Track's Active User Metrics

Identify your most engaged users and optimize your Fintech app to drive meaningful actions.

In the competitive Fintech industry, active users are those who consistently interact with your app and demonstrate trust in managing their finances. Tracking this metric helps you understand user engagement and measure the success of your efforts in fostering healthy financial habits for your customers.

Why Active Users Matter in Fintech

Active users are a critical metric for Fintech apps. They represent users who are actively using your features to manage their finances, such as:

-

Checking account balances and transaction history

-

Transferring funds between accounts

-

Investing or trading

-

Paying bills

-

Budgeting and managing expenses Track User Behavior: /user-behavior/

By focusing on active users, you can:

-

Increase user adoption: Identify features and functionalities that resonate most with active users and use this data to guide product development and encourage broader user adoption.

-

Boost user retention: Analyze how active users engage with your app and identify areas for improvement to keep users engaged and prevent churn.

-

Personalize the user experience: Leverage user behavior data to personalize the app experience and recommend features or investment opportunities that cater to each user's specific financial needs.

Defining Active Users for Your Fintech App with Palzin Track

What constitutes an "active user" in Fintech depends on the specific actions that signify financial management within your app.

Here are some examples of actions that could define an active user in your Fintech app:

- Logging in and checking account balances

- Transferring funds between accounts

- Initiating bill payments

- Creating or editing a budget

- Monitoring investment performance (for investment apps)

Palzin Track allows you to define what an "active user" means for your specific Fintech app. This empowers you to gain a clear picture of which users are actively managing their finances with your app and demonstrate a commitment to financial well-being.

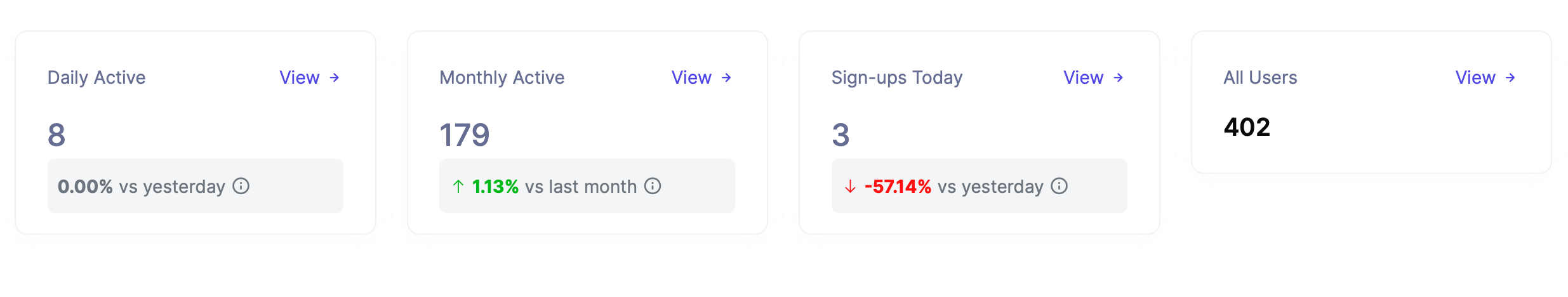

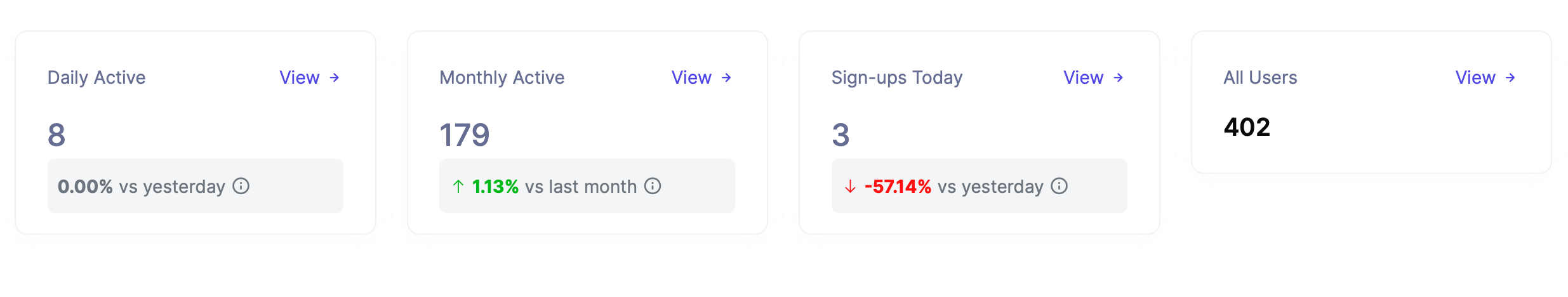

Leverage DAU, WAU, and MAU in Palzin Track

Understanding user engagement over different timeframes provides valuable insights for Fintech apps. Palzin Track helps you track three key active user metrics:

-

Daily Active Users (DAU): This metric is ideal for apps designed for daily financial management activities, like checking balances or monitoring investments.

-

Weekly Active Users (WAU): This metric is useful for apps where users might manage finances on a weekly basis, such as budgeting or initiating bill payments on specific days.

-

Monthly Active Users (MAU): This is a broader metric that provides a general sense of your user base size. It's helpful for all Fintech apps, but use it in conjunction with DAU or WAU for a more granular understanding of user engagement.

By tracking all three metrics (DAU, WAU, and MAU) in Palzin Track, you can see how user engagement unfolds over time. This allows you to identify trends, understand user financial management habits, and tailor your app's functionalities and features to best serve their needs.

Choosing the Right Metric for Your Fintech App

While DAU, WAU, and MAU are all correlated, the best metric for your app depends on several factors:

-

App Functionality: Consider the core features of your app and how often users typically interact with them for financial management purposes. (Daily for checking balances, weekly for budgeting, etc.)

-

User Onboarding: Analyze user behavior within Palzin Track after the onboarding process. See how frequently new users return to the app and engage with financial management features.

-

Industry Standards: Research common usage patterns for similar Fintech apps to understand user expectations and how your app compares.

Palzin Track provides insightful reports that show you how each metric (DAU, WAU, and MAU) is performing. This comprehensive data empowers you to make informed decisions about your Fintech app's development and user engagement strategies. By focusing on active users, you can optimize your app to drive user adoption, boost retention, and ultimately help your users achieve their financial goals.