Deep Dive into FinTech Transactions and Revenue with Palzin Track

Unlock granular insights into transaction volume and revenue streams to optimize your FinTech product with Palzin Track.

In the FinTech landscape, understanding transaction behavior and revenue generation is fundamental to business success. Palzin Track empowers you to go beyond basic metrics by providing a comprehensive view of your FinTech product's transaction data, enabling you to make data-driven decisions that maximize revenue and user growth.

Demystifying Transactions and Revenue in FinTech

-

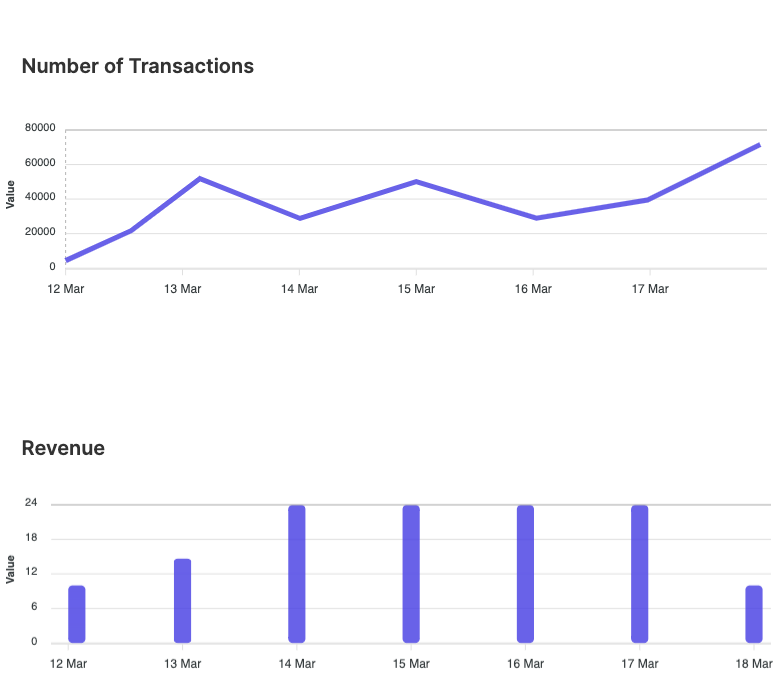

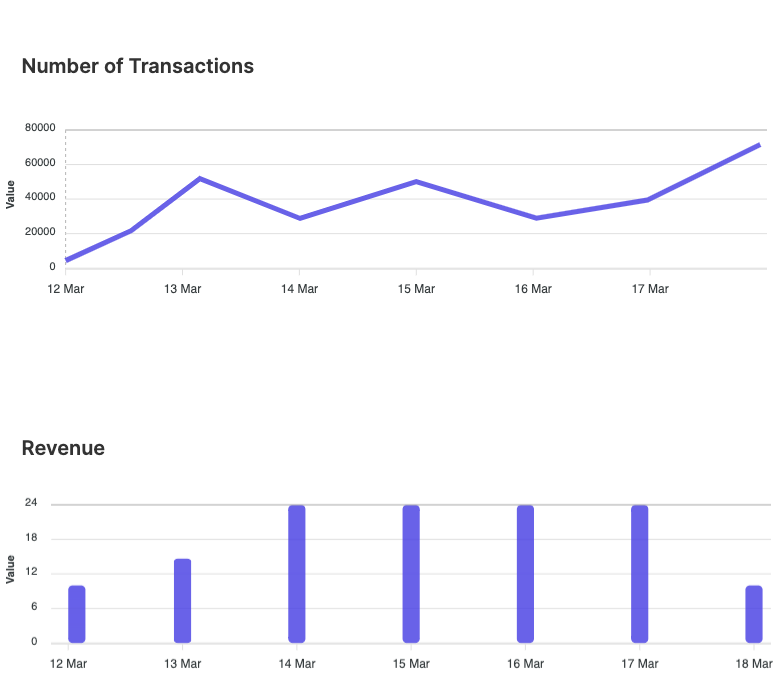

Transactions: These represent individual financial operations conducted through your FinTech platform. Each transaction signifies user activity and has a specific monetary value associated with it.

-

Revenue: This represents the total income generated by your FinTech product, calculated by multiplying the number of transactions by the average transaction value.

Why Transaction & Revenue Analysis Matters in FinTech

Analyzing transaction and revenue data is crucial for FinTech businesses for several reasons:

-

Revenue Growth: By understanding transaction patterns and optimizing product features, you can encourage higher transaction volume and increase overall revenue generation.

-

Customer Segmentation: Analyze transaction data by user segments (e.g., account types, investment strategies) to identify high-value customer cohorts and tailor product offerings or marketing campaigns for maximum impact.

-

Fee Optimization: Analyze transaction types and associated fees to identify opportunities for fee structure adjustments or the introduction of new revenue streams that enhance profitability without compromising user experience.

-

Fraud Detection: Monitor transaction patterns to detect anomalies that might indicate fraudulent activity, safeguarding your users and protecting your business.

Leveraging Palzin Track for Transaction & Revenue Analysis

Palzin Track equips you with a robust suite of tools to gain unparalleled insights into your FinTech product's transaction and revenue data:

-

Funnel Analysis: Visualize user journeys within key functionalities like payment flows or investment processes. Identify drop-off points within these funnels and optimize them to ensure users complete transactions seamlessly.

-

Cohort Analysis: Track transaction behavior of specific user cohorts over time (e.g., users acquired in a particular month). This allows you to identify trends and patterns within these groups and tailor product features or marketing strategies accordingly.

-

Custom Event Tracking: Define specific events within the transaction process (e.g., abandoned cart, successful investment) to gain a granular understanding of user behavior and pinpoint areas for improvement.

-

A/B Testing: [link to A/B Testing in Palzin Track Sitemap] Utilize transaction data from Palzin Track to inform A/B tests of pricing structures, fee models, or user interfaces within your FinTech product. This allows you to determine which variations drive higher transaction volume and revenue.

Strategies to Optimize Transactions & Revenue with Palzin Track Insights

By analyzing transaction and revenue data in Palzin Track, you can implement data-driven strategies to enhance your FinTech product:

-

Reduce Friction in Transaction Flows: Streamline the user experience within key transaction functionalities to minimize drop-off points and encourage successful transaction completion.

-

Personalize User Journeys: Leverage user data to personalize product recommendations, investment strategies, or fee structures, potentially leading to increased transaction frequency and revenue per user.

-

Introduce Freemium Models or Tiered Subscriptions: Consider offering freemium models or tiered subscription plans that cater to diverse user needs and transaction volumes, potentially expanding your user base and generating additional revenue streams.

-

Optimize Fee Structures: Analyze user behavior and transaction data to identify opportunities for optimizing fee structures. This could involve introducing volume-based discounts or adjusting fees for specific transaction types, ensuring a balance between profitability and user satisfaction.

By prioritizing transaction and revenue analysis with Palzin Track, you gain a deeper understanding of your FinTech product's performance. This empowers you to make informed decisions that maximize revenue potential, cultivate user engagement, and propel your FinTech business towards sustainable growth.