Prioritize High-Value FinTech Features with Palzin Track's Feature Audit

Uncover user behavior and optimize your FinTech product with actionable insights from Palzin Track's Feature Audit.

In the dynamic FinTech industry, user adoption and engagement are crucial for success. However, simply offering a plethora of features doesn't guarantee user satisfaction. Palzin Track's Feature Audit empowers you to identify which features resonate most with your FinTech users, allowing you to focus development efforts on high-value functionalities and maximize product ROI.

Demystifying the Feature Audit

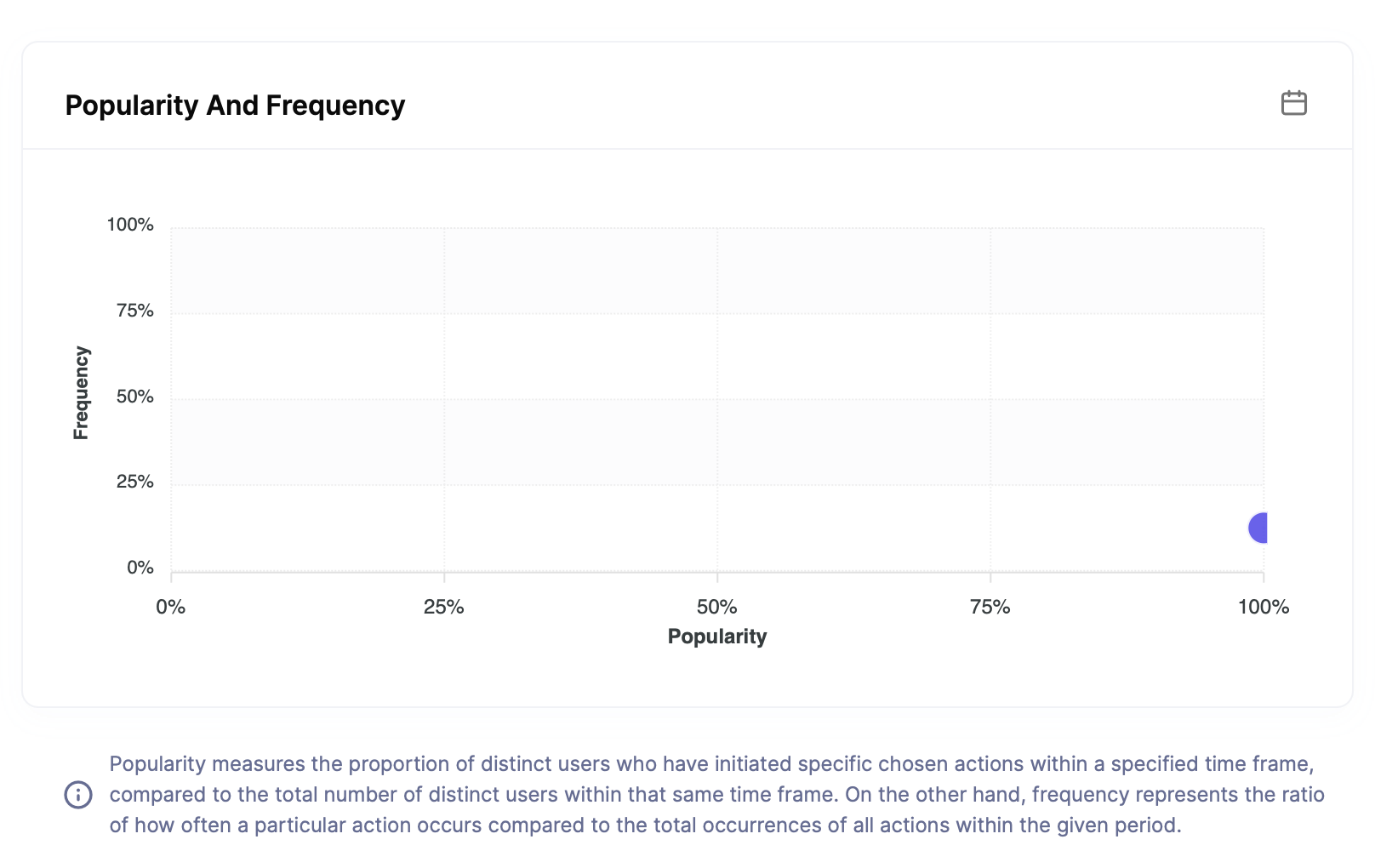

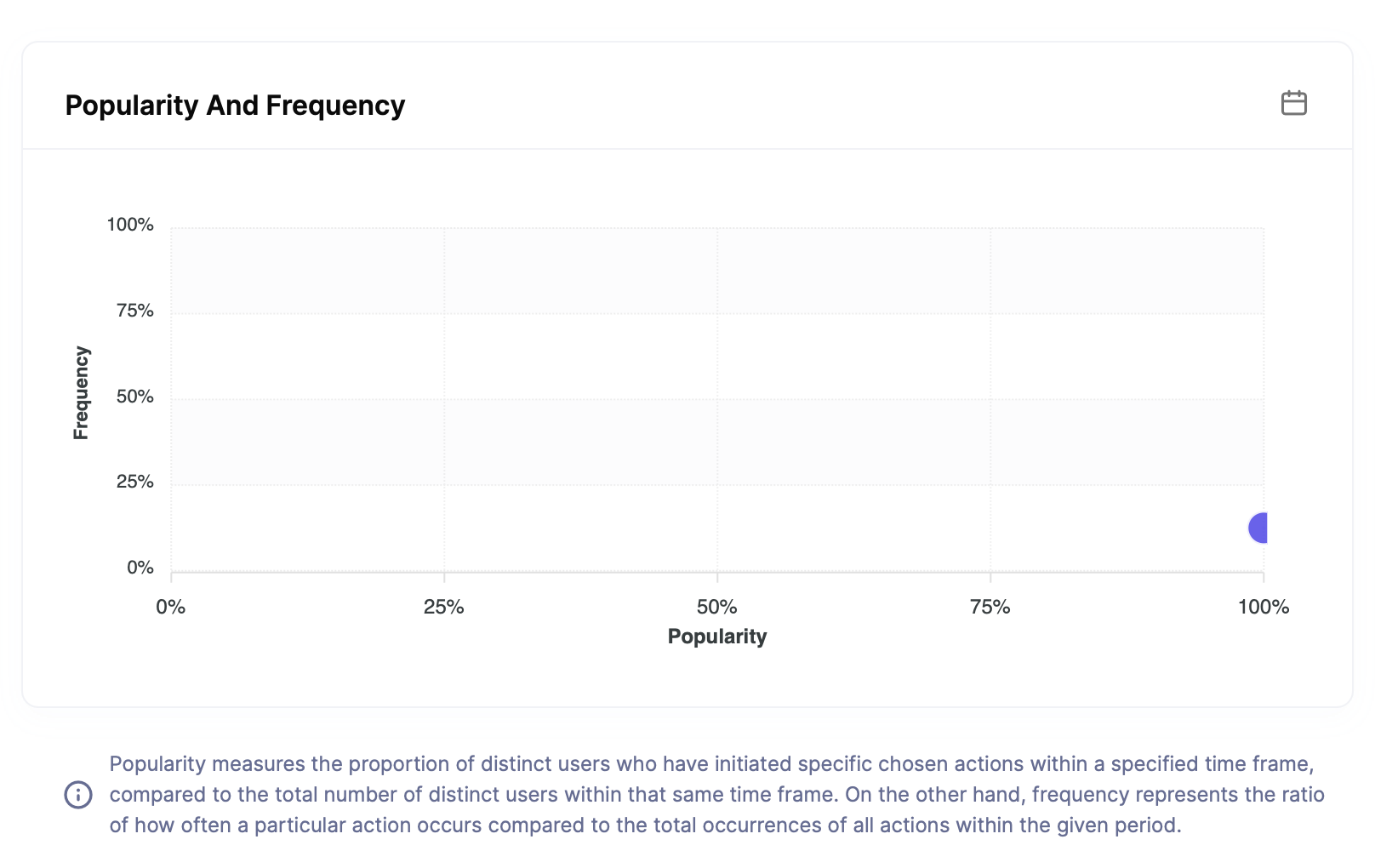

A Feature Audit is a comprehensive analysis of user interaction with your FinTech product's features. By visualizing feature usage on a graph, you gain valuable insights into:

-

Feature Adoption: The percentage of users who engage with a specific feature. This reveals which features users are aware of and utilize.

-

Feature Frequency: The average number of times users interact with a specific feature within a given timeframe. This indicates the perceived value and importance of a feature to users.

Unveiling User Behavior with Palzin Track

Palzin Track equips you with the tools to conduct a robust Feature Audit for your FinTech product:

-

Event Tracking: Define specific user actions within each feature to accurately measure engagement and usage frequency.

-

User Segmentation: Group users based on demographics, financial activity, or subscription plans to identify feature adoption patterns across different user segments.

-

Funnel Analysis: Visualize user journeys within key functionalities to pinpoint areas where users drop off, potentially indicating feature usability issues.

-

User Feedback Integration: Integrate user feedback surveys or in-app chat data with Palzin Track to understand user sentiment towards specific features and identify areas for improvement.

Optimizing Your FinTech Product with Feature Audit Insights

By analyzing Feature Audit data in Palzin Track, you can implement data-driven strategies to enhance your FinTech product:

-

Focus on High-Value Features: Prioritize development and improvement efforts on features positioned in the top right quadrant of the Feature Audit graph (high adoption & high usage). These features resonate most with users and contribute significantly to product value.

-

Revitalize Underutilized Features: Analyze features with low adoption or usage (bottom quadrants). Consider improvement strategies like user education campaigns, A/B testing of feature interfaces, or targeted in-app messaging to increase awareness and engagement.

-

Prioritize Experimentation: Features with moderate adoption but high usage (top left quadrant) present excellent opportunities for A/B testing [link to A/B Testing in Palzin Track Sitemap]. Explore alternative functionalities or user interfaces to determine if you can further enhance user experience and increase adoption across the user base.

-

Deprecate Unnecessary Features: Features consistently positioned in the bottom left quadrant (low adoption & low usage) might be candidates for removal. Carefully evaluate the cost of maintaining these features versus their perceived value to users.

By leveraging Palzin Track's Feature Audit, you can make informed decisions about your FinTech product roadmap, optimize resource allocation, and ensure your product delivers the features and functionalities that truly matter to your target users. This data-driven approach fosters user engagement, maximizes product value, and propels your FinTech business towards sustainable growth.