Identify Churn Risk and Reclaim Lost Ground with Palzin Track

Reduce FinTech user churn and reignite engagement with actionable insights from Palzin Track.

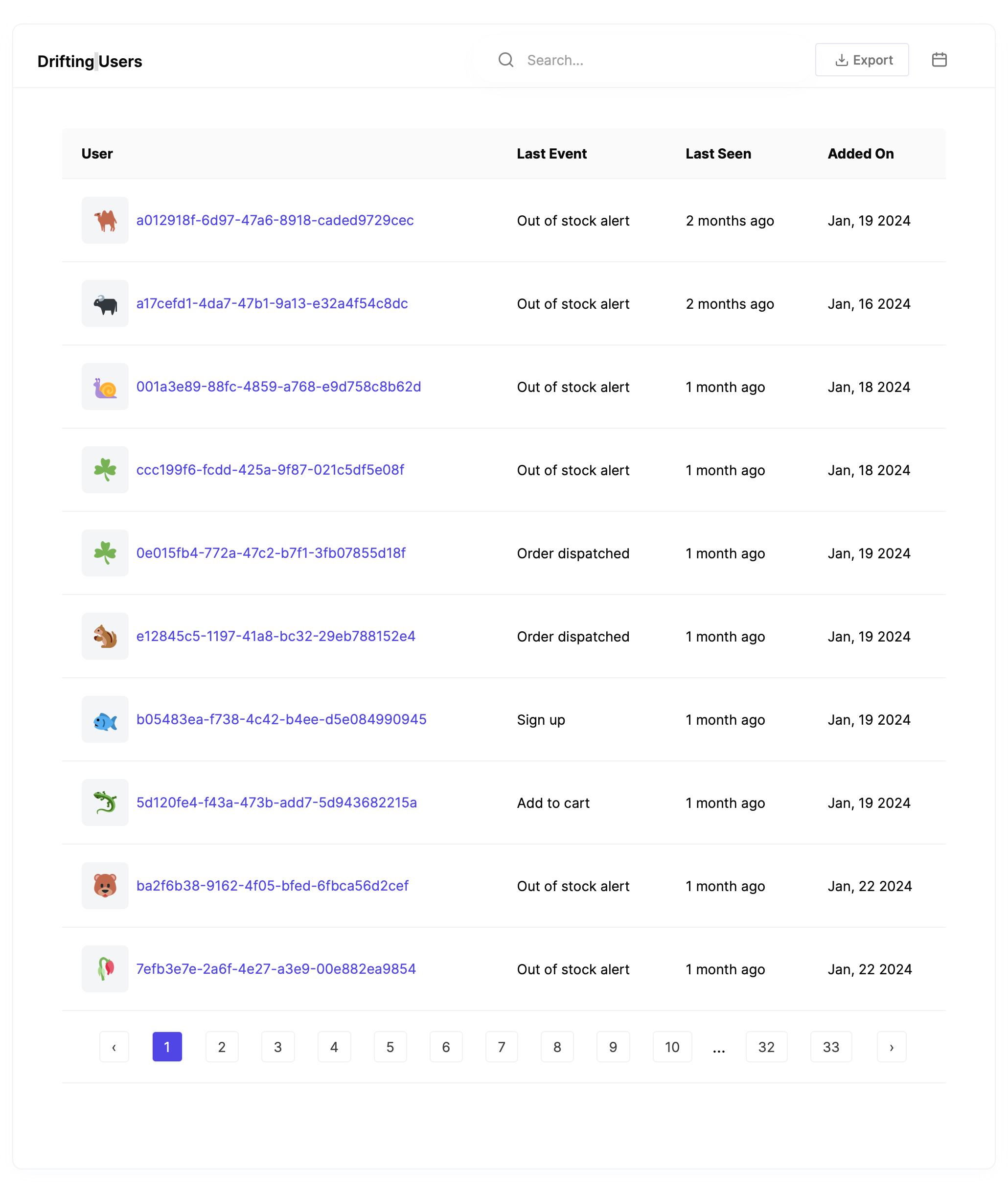

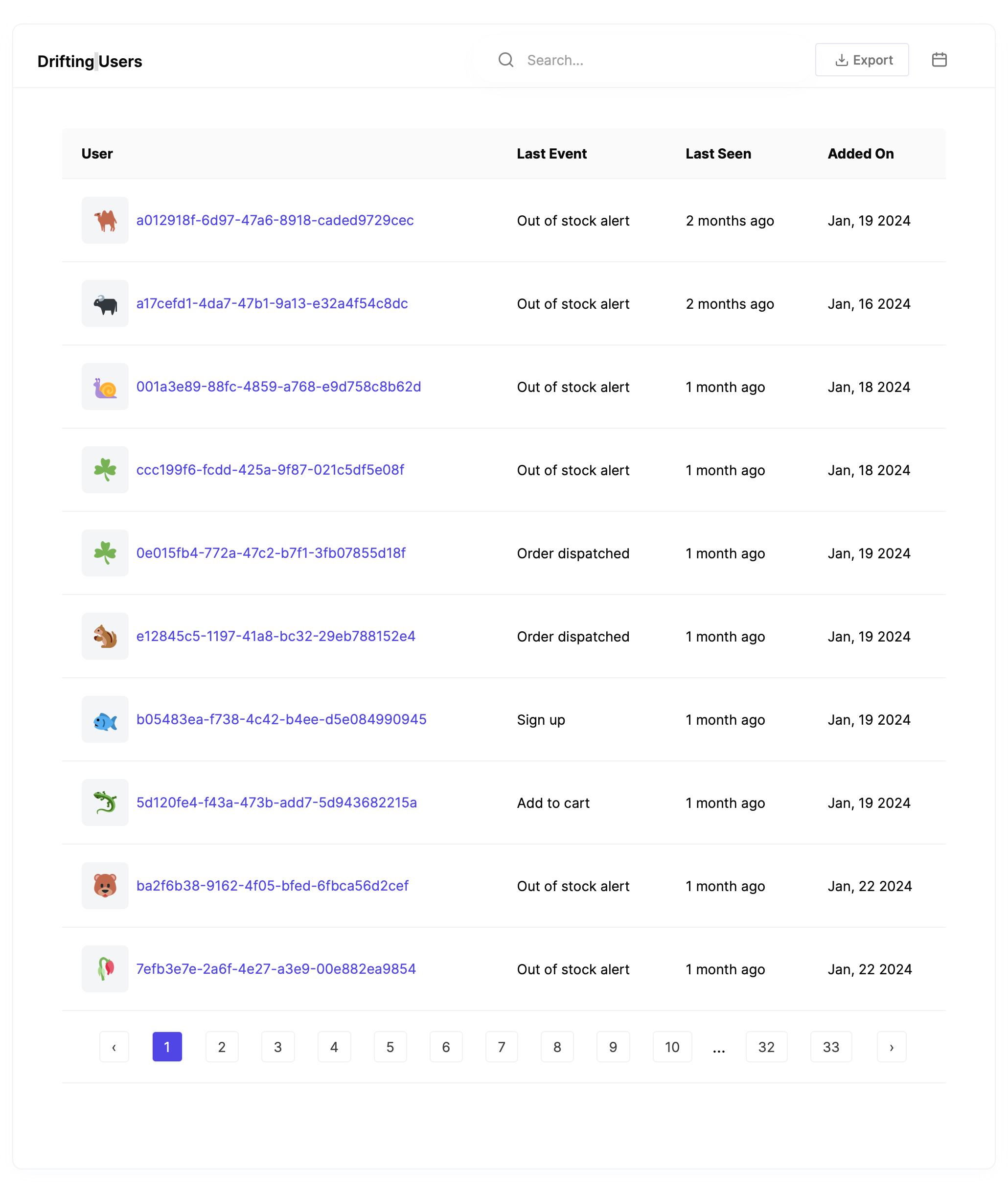

In the competitive FinTech market, user churn can significantly impact your business growth. Early identification of users at risk of abandoning your platform is crucial for implementing effective re-engagement strategies and minimizing churn. Palzin Track empowers you to identify "Drifting away users" – those exhibiting declining engagement – and provides the data-driven insights you need to win them back.

Understanding "Drifting Users" in FinTech

"Slipping Away Users" represent FinTech users who have exhibited a decrease in activity and engagement with your platform over a specific timeframe. They haven't necessarily churned completely, but their diminishing interaction indicates a heightened risk of churn if left unaddressed.

Why Identifying Drifting Users Matters in FinTech

Proactively identifying drifting users in FinTech is critical for several reasons:

-

Reduced Churn: Early intervention allows you to re-engage these users before they completely abandon your platform, ultimately minimizing overall churn rate and safeguarding your customer base.

-

Improved Customer Lifetime Value (CLTV): Re-engaging drifting away users fosters continued product usage, potentially increasing transaction frequency and boosting their overall lifetime value to your business.

-

Targeted Re-engagement Strategies: Analyze user data to understand the reasons behind declining engagement. This empowers you to tailor re-engagement campaigns with personalized messaging and incentives that effectively address user needs and encourage them to return.

Leveraging Palzin Track to Identify Drifting Users

Palzin Track equips you with a comprehensive set of tools to pinpoint drifting users in your FinTech product:

-

Retention Analysis: Track user retention rates over time, identifying user segments with declining engagement patterns indicative of potential churn risk.

-

Cohort Analysis: [link to Cohort Analysis in Palzin Track Sitemap] Analyze user behavior within specific cohorts (e.g., users acquired in the last quarter). This allows you to identify cohorts with higher churn rates and investigate potential causes specific to those groups.

-

User Segmentation: Segment users based on activity levels, transaction frequency, account types, or other relevant criteria. This helps you identify user segments most susceptible to churn and prioritize re-engagement efforts accordingly.

-

Funnel Analysis: Visualize user journeys within key functionalities, highlighting drop-off points within the onboarding or transaction processes. This allows you to identify areas for improvement that contribute to declining user engagement.

Strategies to Re-engage Drifting Users with Palzin Track Insights

By analyzing user data in Palzin Track, you can implement data-driven strategies to win back drifting users:

-

Personalized Re-engagement Campaigns: Leverage user data to personalize communication and offer targeted incentives (e.g., exclusive promotions, educational content relevant to their financial goals) that address their specific needs and encourage them to re-engage with your platform.

-

Improved Onboarding & User Education: Analyze user behavior to identify areas within the onboarding or product experience that might be leading to user frustration and disengagement. Implement improvements or provide additional educational resources to enhance user experience and encourage continued product usage.

-

In-App Messaging: Utilize targeted in-app messages to re-engage drifting users with timely reminders, relevant product updates, or personalized recommendations that entice users to return and explore new functionalities within your FinTech platform.

By prioritizing the identification and re-engagement of drifting users with Palzin Track, you can significantly reduce churn, cultivate a loyal user base, and achieve sustainable growth for your FinTech business.