Prioritize User Retention and Cultivate a Loyal FinTech Customer Base with Palzin Track

Maximize user lifetime value and ensure sustainable growth for your FinTech business with robust user retention strategies powered by Palzin Track.

In the competitive FinTech landscape, user retention is the cornerstone of success. Acquiring new users is crucial, but keeping them engaged and using your platform over time is essential for long-term profitability. Palzin Track empowers you to gain a deep understanding of user behavior and implement data-driven strategies to foster user retention and cultivate a loyal customer base.

Demystifying User Retention in FinTech

User retention refers to the percentage of users who continue to engage with your FinTech app after a specific timeframe following initial sign-up. It's a critical metric that reflects the overall health and sustainability of your FinTech business.

Why User Retention Matters in FinTech

Prioritizing user retention in FinTech is essential for several reasons:

-

Maximized Customer Lifetime Value (CLTV): Retained users become familiar with your platform and are more likely to increase transaction frequency and explore new features over time, ultimately leading to higher CLTV.

-

Reduced Customer Acquisition Costs (CAC): Retaining existing users is significantly more cost-effective than acquiring new ones. Focusing on retention minimizes customer churn and keeps CAC under control.

-

Enhanced Brand Advocacy: Loyal users who have a positive experience with your FinTech app are more likely to recommend it to others, organically expanding your user base through positive word-of-mouth marketing.

Leveraging Palzin Track for User Retention Analysis

Palzin Track equips you with a comprehensive toolkit to analyze user retention and identify areas for improvement in your FinTech app:

-

Cohort Analysis: [link to Cohort Analysis in Palzin Track Sitemap] Track user retention rates for specific cohorts based on acquisition date, demographics, or account types. This allows you to identify user segments with lower retention rates and tailor re-engagement strategies accordingly.

-

User Segmentation: Segment users based on activity levels, transaction frequency, financial goals, or other relevant criteria. This helps you understand the needs and behavior of different user groups and personalize the app experience to enhance engagement and retention.

-

Funnel Analysis: Visualize user journeys within key functionalities like account opening, investment processes, or transaction flows. Identify drop-off points within these funnels and optimize them to ensure users complete actions seamlessly and remain engaged.

-

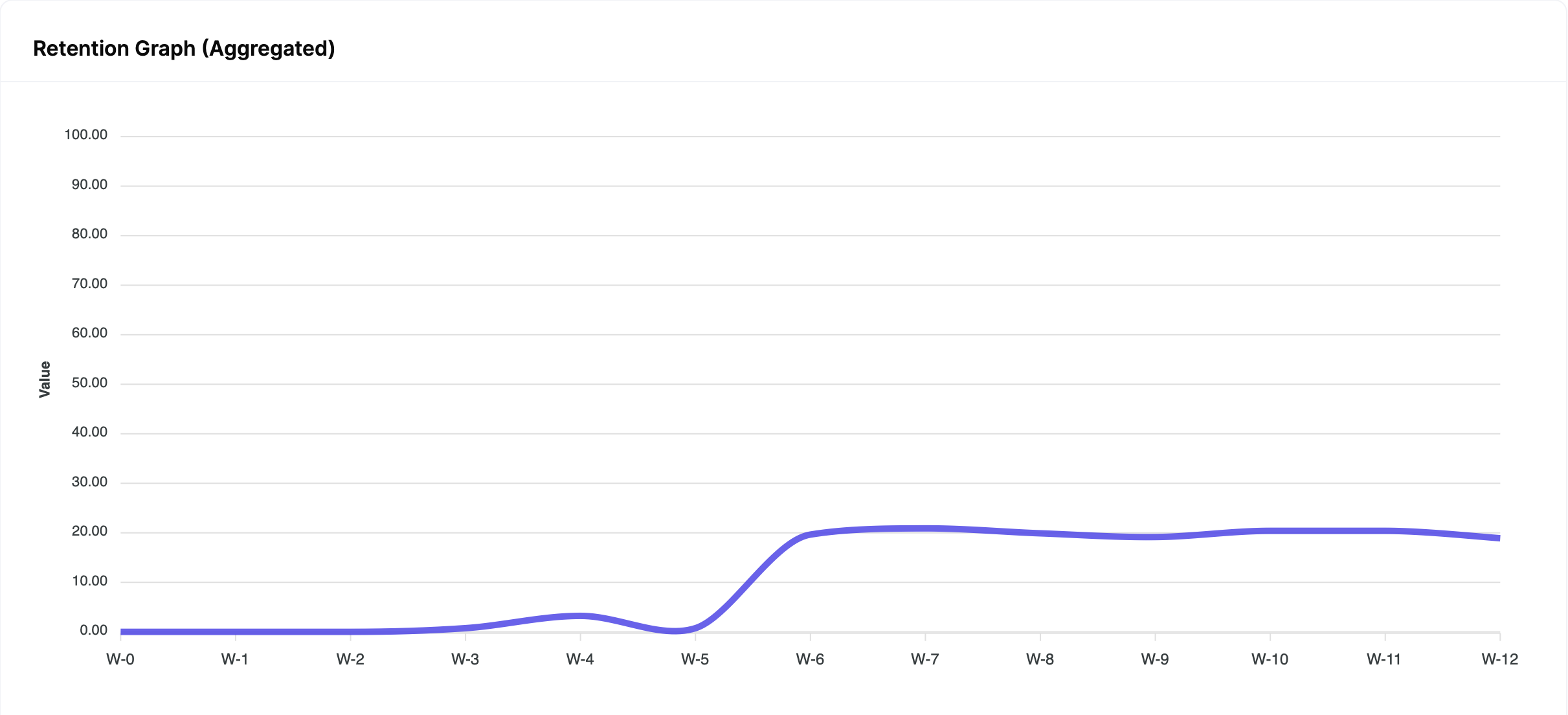

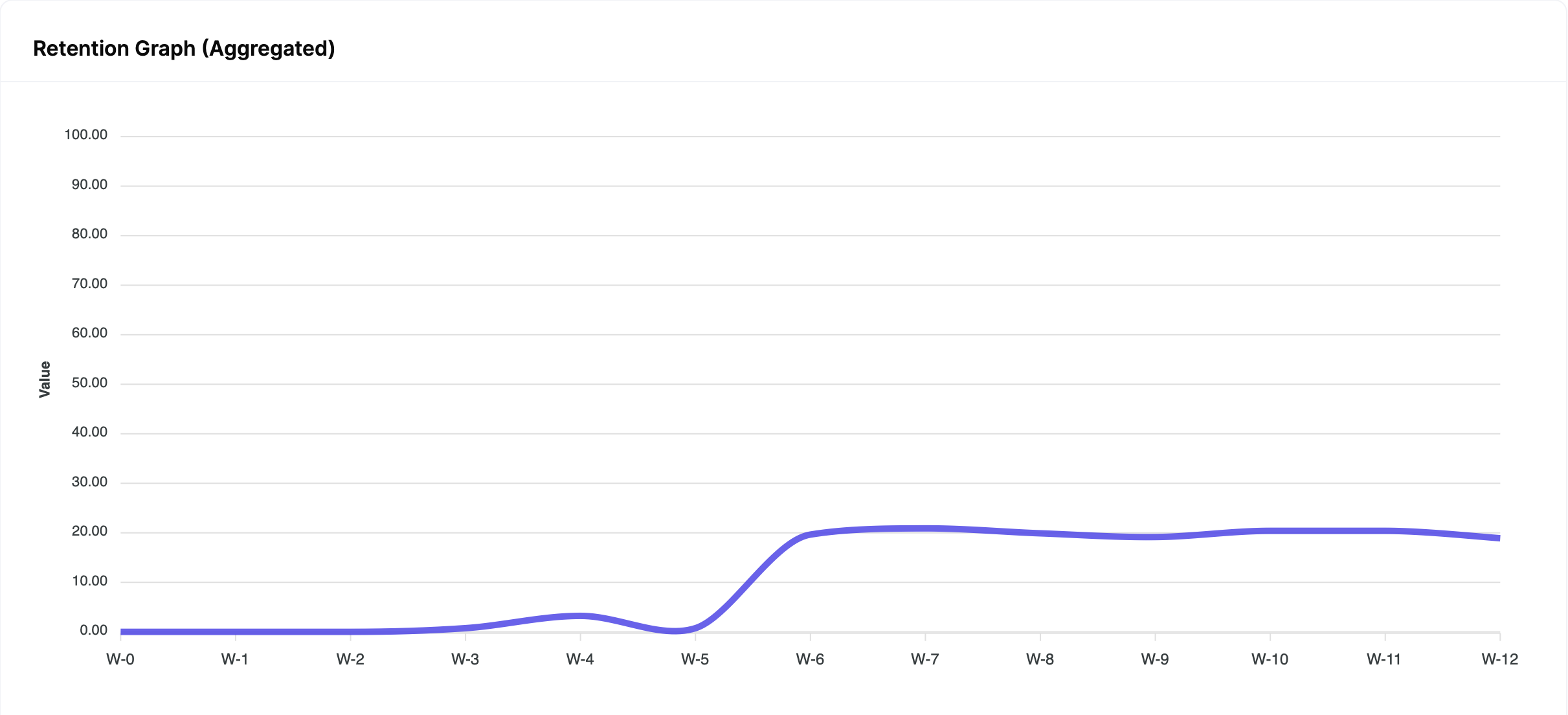

Retention Analysis: Track user retention rates over time and pinpoint periods where churn spikes. Analyze user behavior leading up to churn events to identify potential causes and implement preventative measures.

Strategies to Enhance User Retention with Palzin Track Insights

By analyzing user retention data in Palzin Track, you can implement data-driven strategies to cultivate a loyal user base:

-

Personalized User Onboarding: Leverage user data to personalize the onboarding experience. This could involve tailored investment recommendations, educational content relevant to financial goals, or highlighting features that address specific user needs.

-

Engaging In-App Communication: Utilize targeted in-app messages and push notifications to re-engage users, provide personalized updates, or highlight new features that enhance the overall user experience.

-

Rewards & Loyalty Programs: Consider implementing rewards programs or loyalty incentives to encourage continued engagement and transaction frequency. Offer tiered rewards based on user activity to motivate users and foster long-term platform loyalty.

By prioritizing user retention with Palzin Track, you can minimize churn, cultivate a loyal user base, and achieve sustainable growth for your FinTech business. Palzin Track empowers you to transform casual users into dedicated advocates, propelling your FinTech platform towards long-term success.

FinTech User Retention Benchmarks: Short vs. Long Term

User retention in FinTech varies by sub-sector and target user. Here's a general guide:

-

1 Month:

- Median: 40-50%

- Target: Aim for at least 45% to indicate a healthy, engaged user base.

-

1 Year:

- Median: 20-30%

- Target: Strive for 25% to signify a loyal user base integrated into your platform.

Remember: These are starting points. Analyze your user base and industry trends to define achievable targets for your FinTech app. Continuously monitor and improve retention rates to understand churn and implement data-driven re-engagement strategies.