Optimize Your FinTech Customer Acquisition with Palzin Track

Unlock actionable insights to reduce customer acquisition costs (CAC) and maximize ROI for your FinTech product.

In the competitive FinTech landscape, acquiring new customers efficiently is critical for sustainable growth. Understanding your Cost of Acquisition (CAC) empowers you to measure the effectiveness of your marketing and sales efforts, optimize resource allocation, and maximize the return on investment (ROI) for user acquisition strategies. Palzin Track equips you with the data and insights you need to make data-driven decisions and refine your customer acquisition strategies.

Demystifying Cost of Acquisition (CAC) for FinTech

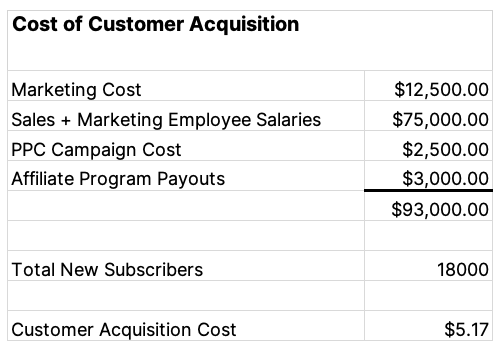

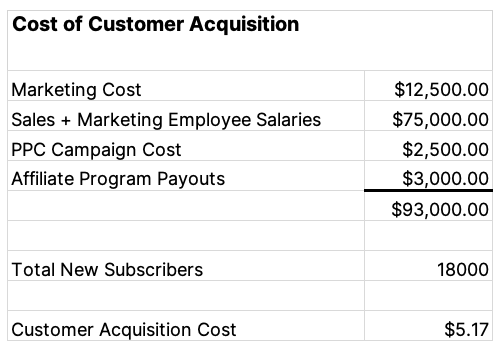

CAC represents the total cost associated with acquiring a new customer for your FinTech product or service. It encompasses all expenses incurred in marketing, advertising, sales commissions, onboarding processes, and any other activities that directly contribute to customer acquisition.

Why CAC Matters in FinTech

CAC is a crucial metric for FinTech businesses to monitor and optimize for several reasons:

-

Financial Sustainability: A lower CAC ensures profitability by minimizing the cost per user acquisition. It allows you to invest in product development, customer retention strategies, and future growth initiatives.

-

Informed Marketing & Sales Strategies: By analyzing CAC data, you can identify the most effective marketing channels and sales tactics for customer acquisition, enabling you to allocate resources efficiently and maximize ROI.

-

Competitive Advantage: Optimizing CAC allows you to offer competitive pricing and scale customer acquisition efforts effectively, giving you a competitive edge in the FinTech market.

Leveraging Palzin Track for CAC Optimization

Palzin Track equips you with a comprehensive suite of tools to analyze and optimize your FinTech customer acquisition efforts:

-

Campaign Tracking: Integrate marketing campaign data with Palzin Track to track user acquisition across various channels (e.g., social media, paid advertising, referrals). This allows you to identify the most cost-effective channels for acquiring new customers.

-

Funnel Analysis: Visualize user journeys within your FinTech product, highlighting potential drop-off points within the onboarding or activation process. This helps you identify areas for improvement and streamline customer acquisition funnels to reduce friction.

-

Attribution Modeling: Utilize Palzin Track's attribution modeling capabilities to understand the complex customer journey and attribute conversions across multiple touchpoints. This allows you to accurately assess the contribution of each marketing channel to customer acquisition.

-

A/B Testing: [link to A/B Testing in Palzin Track Sitemap] Leverage user behavior data from Palzin Track to inform A/B tests of landing pages, onboarding flows, or marketing copy. This allows you to optimize user acquisition touchpoints for higher conversion rates and lower CAC.

Strategies to Reduce CAC with Palzin Track Insights

By analyzing CAC data in Palzin Track, you can implement data-driven strategies to acquire customers more efficiently:

-

Target the Right Audience: Refine your target audience based on user demographics, behavior, and financial needs. This allows you to tailor marketing messages and acquisition strategies for higher conversion rates.

-

Optimize Marketing Channels: Allocate marketing resources strategically based on CAC data. Prioritize channels with lower acquisition costs and higher customer lifetime value (CLTV).

-

Streamline Onboarding: Identify and eliminate obstacles within the customer onboarding process. Ensure a smooth and frictionless experience to maximize conversion rates and reduce customer churn.

-

Upsell & Cross-Sell Existing Users: Leverage Palzin Track user data to identify opportunities for upselling and cross-selling existing customers, maximizing revenue from acquired users and lowering overall CAC.

By prioritizing CAC optimization with Palzin Track, you can achieve a sustainable competitive advantage in the FinTech market. Palzin Track empowers you to acquire customers more efficiently, maximize ROI for user acquisition efforts, and accelerate growth for your FinTech business.